Picture this: It’s Monday morning. You walk into the office, coffee in hand, ready to tackle the week. Then, your bright young executive—the one you spent the last six months training, the one who finally understands your workflow—asks for a “quick chat.“

Your heart sinks. You know exactly what’s coming. Nothing ever good comes from a “quick chat”. This usually means your bright young talent has made up his or her mind.

They’re leaving. Maybe for a bigger and better role at an MNC, or maybe just for a RM200 increment at a competitor down the street. You smile, wish them well, and promise to write up a glowing reference. But inside? You’re exhausted. You’re tired of your business feeling like a “training academy” where you polish raw talent only for someone else to reap the rewards. In other words, you’re tired of having your talent stolen over a measly RM 100 salary difference.

If you run an SME in Malaysia, this story is probably painfully familiar. We often feel like we’re fighting a losing battle against the corporate giants. We can’t always match their deep pockets, and we certainly can’t throw cash bonuses at every problem.

High Turnovers?: Why SMEs Lose the Talent War

| The Challenge | The Employee’s Perspective (“Why I Leave”) | The SME’s Struggle (“Why It’s Hard”) | The Strategic Fix |

| 1. The Salary Gap | “My friend at an MNC gets paid RM500 more for the same role. I can’t ignore the difference.” | Thin Margins: You can’t afford it. You simply cannot compete dollar-for-dollar with giant corporations without bleeding cash. | Shift Value: Stop competing on cash. Compete on Lifestyle (Flexibility) and Security (Insurance/Benefits). |

| 2. The “Flat” Career Ladder | “I’ve been here 2 years and I’m still doing the same thing. There’s no ‘Senior Manager’ role to move into.” | Structural Limits: You have a flat hierarchy. You can’t invent a new management layer just to give someone a promotion. | Growth Strategy: Offer rapid skill acquisition and exposure to high-level decisions that they wouldn’t get in a rigid corporate structure. |

| 3. The Benefits Deficit | “If I get sick, I have to go to a government hospital. An MNC gives me a private medical card.” | High Premiums: Group insurance is perceived as expensive and complicated to set up for a small team of 5-10 people. | Smart Coverage: Use Deductible Plans (staff pays first RM300) to slash premiums while still offering catastrophic protection. |

| 4. The “Jack-of-All-Trades” Burnout | “I was hired for Marketing, but I’m doing Sales, Admin, and Event Planning. I’m exhausted.” | Resource Scarcity: You don’t have the budget for specialists. Everyone must wear multiple hats for the business to survive. | Micro-Recognition: Acknowledge the extra load. Use the “Makan Culture” (rewards/meals) to validate their effort so they feel seen, not used. |

| 5. The “No-Name” Brand Anxiety | “Nobody knows the company I work for. I worry it looks bad on my CV compared to a big brand name.” | Lack of Prestige: You aren’t a household name like Maybank or Petronas. You can’t offer “resume prestige.” | Personal Brand: Frame the role as “Entrepreneurial Training.” They aren’t just an employee; they are building a business alongside the founder. |

| 6. The Commute (Traffic) | “I spend 2 hours in the Federal Highway jam every day. It’s destroying my mental health.” | Old School Mindset: A fear that if you can’t see them at their desks at 9:00 AM, they aren’t working. | Anti-Jam Policy: Implement 7 AM – 4 PM shifts or Hybrid WFH days. It costs nothing but saves their sanity. |

But here is the truth that might surprise you: The rules of the game have changed – because younger and younger people from different generations are joining the labour market. They are brought up differently, with varying cultures and influence, so what you know may not be enough to handle a younger workforce.

For Gen Z and Millennial talent entering the workforce in 2026, the paycheck is still important—but it is no longer the only thing. These generations are driven by different values. They are looking for flexibility, genuine purpose, and a sense of security that cold, hard corporate structures often lack.

If you thought the retention landscape was tough before, the latest data from the 2025 Hays Asia Salary Guide is a wake-up call. Released in March 2025, the report reveals a staggering 62% of working professionals in Malaysia intend to change jobs—a figure that has more than doubled compared to 2024. This isn’t just a ripple; it’s a tidal wave. For SME owners, this means that statistically, nearly two-thirds of your workforce are currently eyeing the exit door, driven by a market that is aggressively poaching talent. The ‘wait and see’ approach is no longer an option; proactive retention is now a survival strategy.

The good news? You don’t have to bankrupt your business to win the talent war. You just need to stop playing by the “salary rules” and start playing to your strengths as an SME.

The Malaysian SME Talent Crisis

| The Statistic | The Reality | The Impact on Your Business |

| 62% | (UPDATED) Percentage of Malaysian professionals planning to switch jobs in 2025 (Hays Asia Salary Guide). | Nearly 2 out of 3 of your staff are actively thinking about leaving right now. |

| Double | The rate of intended job changes in 2025 compared to 2024. | The “loyalty” of previous years has evaporated; the market is highly volatile. |

| 1 in 6 | Number of Gen Z graduates who actively want to work for an SME (vs. MNC/Gig work). | You are fighting for a tiny pool of talent against giant brands. |

| 1.5x – 2x | The “Hidden Cost” of replacing a single productive employee (recruitment + training + lost revenue). | Losing a RM4,000/month exec doesn’t cost you RM4,000; it costs you roughly RM72,000 in total value lost. |

| #2 Reason | “Lack of Career Growth” & “Work-Life Balance” are tied as the key drivers for leaving. | You can’t just pay more; if the work culture is rigid, they will still leave. |

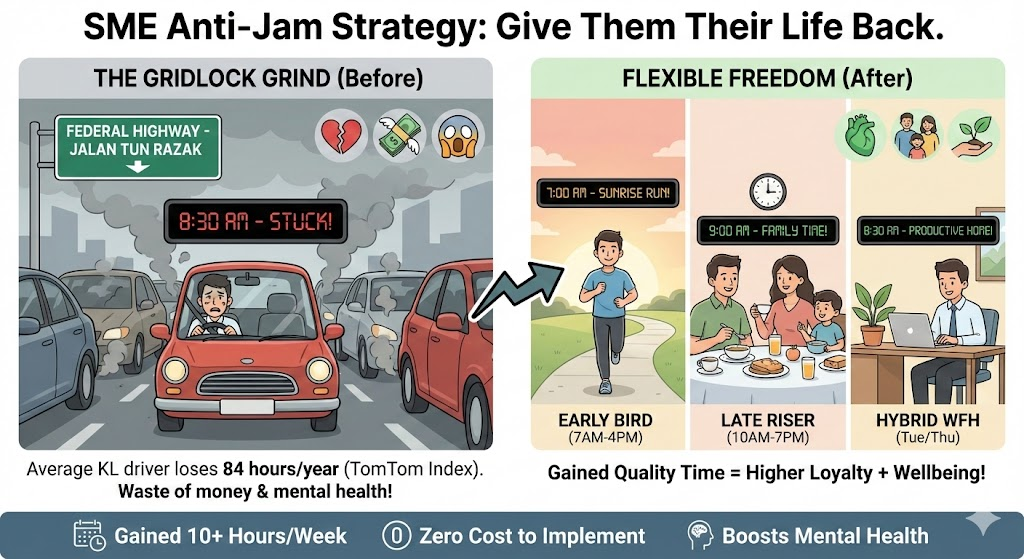

The “Anti-Jam” Strategy: Flexibility as Currency

If you are based in the Klang Valley, Penang, or Johor Bahru, your biggest competitor for talent isn’t another company—it is the traffic.

Recent data paints a brutal picture of the daily commute. In 2025, the average Klang Valley worker lost approximately RM21,250 annually in productivity and “hidden time costs” just sitting in gridlock. TomTom’s latest traffic index reveals that Kuala Lumpur drivers lose nearly 84 hours a year—that’s 3.5 full days of their lives—staring at brake lights during rush hour. For a Gen Z employee who values mental health, this daily grind isn’t just an annoyance; it is a dealbreaker.

Time lost due to traffic in rush hour in 2025

84 hours = 3 days, 12 hours

3 hours 50 min more than in 2024.

Source: TomTom

The SME Advantage: This is where your agility becomes your superpower. Large MNCs are often bogged down by global “Return to Office” mandates or rigid 9-to-5 structures that are impossible to change without management approval. You, however, can change your policy tomorrow, so play this to your own advantage. We can’t change our location, the traffic conditions, and perhaps the salary range we pay our staffs, but we can be nimble and change many working policies overnight.

How to Implement It: Don’t just offer “flexibility” (which is vague); offer specific “Anti-Jam Schedules”:

- The Early Bird: 7:00 AM – 4:00 PM (Beats the morning crawl).

- The Late Riser: 10:00 AM – 7:00 PM (Avoids the evening peak).

- The Hybrid Anchor: Work From Home (WFH) on Tuesdays and Thursdays—statistically the worst traffic days in KL.

By giving your staff back 10 hours of their life every week, you are offering a “lifestyle raise” that a competitor’s RM200 salary increment simply cannot match. You aren’t just an employer; you are the one saving them from the Federal Highway parking lot.

The “Currency of Time” Strategy

For Gen Z and Millennial employees, time is the new currency, often valued as highly as the paycheck itself. Unlike previous generations who viewed “face time” in the office as a badge of honor, these younger cohorts prioritize autonomy and mental well-being. By offering flexible work hours—specifically an “Anti-Jam” schedule—you aren’t just changing a timestamp; you are actively giving them back 10-15 hours of their life every week that would otherwise be lost to the Federal Highway. In their eyes, an employer who saves them from the stress of a 6 PM commute is effectively giving them a “lifestyle raise,” validating their desire for a life outside of work and proving that you value their output more than their physical presence.

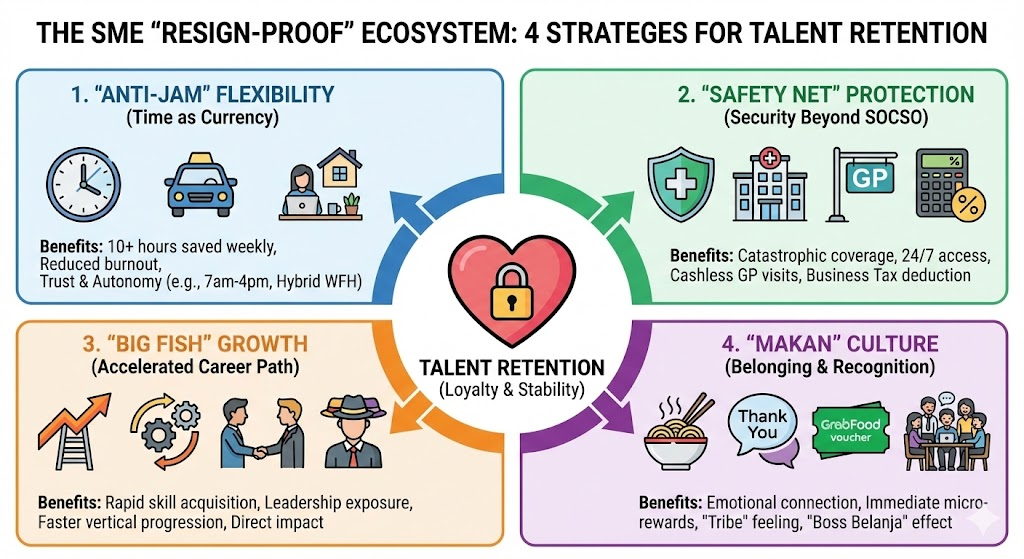

2. The “Safety Net” Strategy: Protection Beyond SOCSO

While flexible hours buy you goodwill, security buys you loyalty.

In a post-pandemic world, Gen Z and Millennial employees are far more health-conscious—and health-anxious—than previous generations. They’ve seen how quickly a medical emergency can drain a bank account.

This is where you can outmaneuver the “salary war.”

The Psychology of the Medical Card

If you give an employee a RM200 monthly raise, it often disappears into their daily expenses—petrol, tolls, and food inflation. Within three months, that “raise” is forgotten. However, giving them a Group Hospitalization & Surgical (GHS) card creates a permanent psychological anchor. Every time they open their wallet and see that card, they are reminded: “If I get sick, my company has my back.”

The “SME Hack” to Make it Affordable

Many business owners assume private medical insurance is a luxury reserved for big corporations. This is a myth. You don’t need to buy a “zero-deposit” luxury plan. Instead, look for “Cost-Sharing” or “Deductible” plans.

- How it works: The employee pays the first RM300 or RM500 of any hospital admission, and the insurance covers the remaining RM50,000+.

- Why it helps retention: It keeps your premiums low (often 20-30% cheaper) while still protecting your staff from the catastrophic costs of surgery. You are effectively telling them, “We might not be a giant MNC, but we will never let you go bankrupt because of bad luck.”

The SOCSO Misconception

Don’t fall into the trap of thinking, “But I already pay SOCSO!” Your employees know that SOCSO primarily covers work-related injuries. It won’t help them if they get Dengue fever or need an emergency appendectomy on a Sunday. Bridging that gap with private insurance is often the deciding factor that stops a key employee from jumping ship to a competitor who offers “full benefits.”

The “Everyday” Win: Solving the GP Headache

While hospitalization coverage is your “catastrophe” shield, Outpatient GP coverage is your “daily” appreciation tool. Think about it: your staff might never use their surgical card (and hope they don’t), but they will catch the flu, get a migraine, or need antibiotics a few times a year. For a junior executive, shelling out RM80 at a clinic feels like a “tax” on being sick. By offering a cashless GP panel—now easily managed through apps—you remove that friction entirely. It turns a negative experience (“I have to pay to see a doctor”) into a positive one (“I just scanned my company app and walked out”). Unlike surgical insurance which sits in a drawer, GP coverage is a benefit they use and value multiple times a year, constantly reinforcing that the company cares about their everyday well-being.

Tax Savings for The Bosses & Direct Savings for Employees

For the SME: The Tax Efficiency Hack Giving a cash bonus is great, but it’s expensive. You have to pay the bonus plus the employer’s EPF (13%), and the employee gets taxed on it. However, Group Insurance premiums are generally treated as a deductible business expense in Malaysia (under “staff welfare”). By shifting a portion of your compensation package into insurance, you are effectively lowering your company’s chargeable income. You are buying loyalty with pre-tax Ringgits, making it one of the most cost-efficient ways to reward your team compared to a raw salary hike.

For the Staff: Preventing Total Financial Collapse For an average Malaysian employee earning RM4,000 a month, a diagnosis of a major illness like cancer or a heart attack is not just a health crisis; it is a financial death sentence. Treatment costs can easily exceed RM60,000 to RM100,000—an amount that wipes out decades of savings or forces them into debt. By providing a comprehensive medical card, you aren’t just paying a bill; you are removing the risk of bankruptcy from their lives. You are ensuring that if the worst happens, they don’t have to resort to GoFundMe campaigns or borrowing from loan sharks. They can focus on recovery and returning to work, knowing their company stood by them when it mattered most.

SME Group Health Insurance: Allianz vs. AIA

| Feature | Allianz (SME Choice Plus) | AIA (A-SME Flex) |

| Annual Limit | Up to RM300,000 | Up to RM120,000 |

| Hospital Admission | Fully Covered (No Co-payment mentioned) | Covered (Co-payment status not specified in text) |

| Plan Structure | Single product structure mentioned. | 3 Tiers: Starter, Standard, and Business. |

| Outpatient Care | Optional Rider (GP & Specialist) | Optional Rider (GP & Specialist) |

| Cashless Facility | Yes (Medical Card provided) | Yes (Medical Card provided) |

| Shariah Compliance | Conventional Insurance | Offers A-SME Flex-i (Takaful option available) |

| Best For | SMEs looking for higher annual limits and full coverage on admissions. | SMEs looking for tiered options or specifically requiring a Takaful (Islamic) solution. |

3. The “Big Fish” Strategy: Sell Growth, Not Just Titles

One of the main reasons ambitious young talent leaves big corporations is the “Cog in the Wheel” syndrome. In an MNC, a fresh graduate might spend three years doing nothing but updating one specific column in a spreadsheet. They are bored, and they feel invisible and soon enough they feel like they are not learning anything and suffer from a lack of purpose.

The SME Advantage: ” accelerated Learning” In a Small and Medium Enterprise, you can’t afford specialists; you need generalists. Use this to your advantage. When hiring or retaining Gen Z talent, pitch your company as a “Leadership Bootcamp.” Remind them that in a bank, they will be an analyst for five years. In your company, they will sit in on client pitches, learn how supply chains work, and see how a P&L is managed—all in their first 12 months. This means the SME path offers much more drastic growth curve for the young professionals.

The Strategy: Don’t wait for the annual review to talk about their future. That’s too slow for 2026.

- The “6-Month Check-In”: Sit down with your key staff twice a year. Don’t just talk about their KPIs (what they did for you); talk about their skills (what you are doing for them).

- The “Shadow” Perk: Allow your top performers to “shadow” you or senior managers on important business trips or high-level meetings. This costs you nothing but gives them a massive sense of importance and exposure that they would never get in a corporate giant.

Why this retains talent: You are reframing the narrative. You aren’t “smaller” than an MNC; you are “faster.” You offer a vertical career trajectory that would take a decade to achieve in a corporate hierarchy.

4. The “Makan” Culture: Belonging & Recognition

Malaysians don’t just work for companies; they work for people. The phenomenon of “Quiet Quitting” usually happens not because the work is hard, but because the employee feels invisible.

The SME Advantage: You Are Visible In a multinational corporation, the CEO is a mythical figure who lives in an ivory tower (or a different time zone). In an SME, you are right there. This proximity is your secret weapon. When a staff member feels a genuine personal connection with the boss—when they know you care about their career and their well-being—that creates a “social anchor.” It becomes much harder for them to resign for a small salary bump because they feel they are leaving a “tribe,” not just a payroll.

The Strategy: You don’t need a grand annual gala dinner to build culture. In Malaysia, the strongest bonds are built over meals. Meals take place everyday, giving you an opportunity to bond and connect with your people.

- The “Boss Belanja” Effect: A surprise team lunch on a Friday or a “Teh Tarik” session where you pay isn’t about the RM150 you spend. It’s about the signal: “I appreciate you.”

- Micro-Rewards: Did someone pull a late night to finish a proposal? Don’t just say thanks. Send them a RM50 GrabFood voucher immediately. Speed matters. It shows you noticed the effort in the moment.

- Know Their Story: Make it a point to know one personal thing about every staff member—their hobby, their kids’ names, or their career dream. When you ask, “How is your daughter’s exam?” it builds more loyalty than a generic “Good job” email ever will.

Conclusion: Playing to Your Strengths as a Small/medium Sized Businesses is Key to Talent Retention

Winning the talent war in 2026 isn’t about having the deepest pockets; it’s about having the clearest understanding of what your people actually value.

Stop trying to be a “mini-MNC” and start leaning into your strengths as an agile, human-centric SME. You don’t need to overhaul your entire HR handbook overnight. Start small. Review your working hours next week. Call an agent to ask about a basic medical card. Have an honest coffee chat with your team about their future.

The best talent doesn’t always go to the highest bidder; they go where they feel safe, valued, and heard. By following and implementing the strategies laid out in this article, you are effectively building a strong, attractive, beneficial working environment that truly appeals to younger generation workforce (who tend to jump ships more regularly). Talent retention prevents replacement costs associated when a senior staff leaves for greener pastures. Talent retention also promotes growth of your current workforce, allowing them to improve and grow and add more value to your business.

The 30-Day “Stop the Bleeding” Action Plan

You don’t have to change everything overnight. Follow this weekly schedule to transform your retention strategy without overwhelming your operations.

Week 1: The “Time” Audit (Quick Wins)

- Day 1: Analyze your team’s commute. Send a simple survey: “How long do you spend in traffic daily?” and “What are your most productive hours?”

- Day 3: Draft the “Anti-Jam” Policy. Decide on the specific windows (e.g., 7am–4pm or 10am–7pm).

- Day 5: Announce the trial run. Tell the team: “Starting next Monday, we are trialing flexible hours for one month to help you beat the jam.” (Framing it as a trial reduces risk).

Week 2: The “Culture” Injection (Morale Boost)

- Day 8: Identify the “Unsung Hero.” Who stayed late last week? Who fixed a problem without being asked?

- Day 10: The “Boss Belanja” Lunch. Take the team out. No formal agenda. Just food and bonding.

- Day 12: Set up a “Micro-Reward” system. Buy a stack of RM50 Grab/Touch ‘n Go vouchers. Keep them in your drawer. Hand one out the next time you see great work.

Week 3: The “Security” Layer (Financial Safety)

- Day 15: Contact an SME insurance broker. Ask specifically for: “A Group Hospitalization quote with a deductible option (RM300) to keep premiums low.”

- Day 17: Compare quotes. Look at the “Room & Board” limit (RM150-RM200 is standard) and Annual Limit (RM20,000+ is decent for starters).

- Day 19: Review the budget. Identify tax savings. (Remember, insurance premiums are a tax-deductible expense).

Week 4: The “Future” Talk (Career Pathing)

- Day 22: Schedule 1-on-1 “Growth Chats” with your top 20% talent.

- Day 24: Conduct the chats. Rule: You are not allowed to talk about current tasks. Ask: “What skills do you want to learn this year?” and “Where do you see yourself in 2 years?”

- Day 30: Map their “Big Fish” journey. Give them a new responsibility that aligns with their growth (e.g., leading a pitch or mentoring a junior).

The SME Talent Retention Checklist

SCORE YOUR BUSINESS: (Check the boxes that apply to you. If you check fewer than 5, your retention risk is HIGH.)

Strategy 1: Flexibility & Lifestyle

- [ ] Do we offer flexible start/end times to avoid peak traffic?

- [ ] Do we allow at least 1 day of remote work (WFH) per week?

- [ ] Do we measure output (results) rather than hours sat in a chair?

Strategy 2: Security & Safety Net

- [ ] Do we provide a Group Medical Card (Hospitalization) for staff?

- [ ] Do we cover Outpatient GP visits (cashless app or claims)?

- [ ] Is the insurance coverage clearly explained to staff during onboarding?

Strategy 3: Growth & Career

- [ ] Do junior staff have exposure to senior meetings/client pitches?

- [ ] Do we have a scheduled “Career Chat” (separate from performance review) at least once a year?

- [ ] Is there a clear path for promotion that doesn’t rely on someone else retiring?

Strategy 4: Belonging & Culture

- [ ] Do we celebrate small wins immediately (within 24 hours)?

- [ ] Does the boss/owner know at least one personal interest of every employee?

- [ ] Do we have regular, informal team bonding (lunch/teh tarik) paid by the company?